LATAM - YC connection in a Nutshell

The number of startups from LATAM in YC constantly decreases from 13% of the YC S21 batch to 7% in S22 and 4% in the current W23 batch.

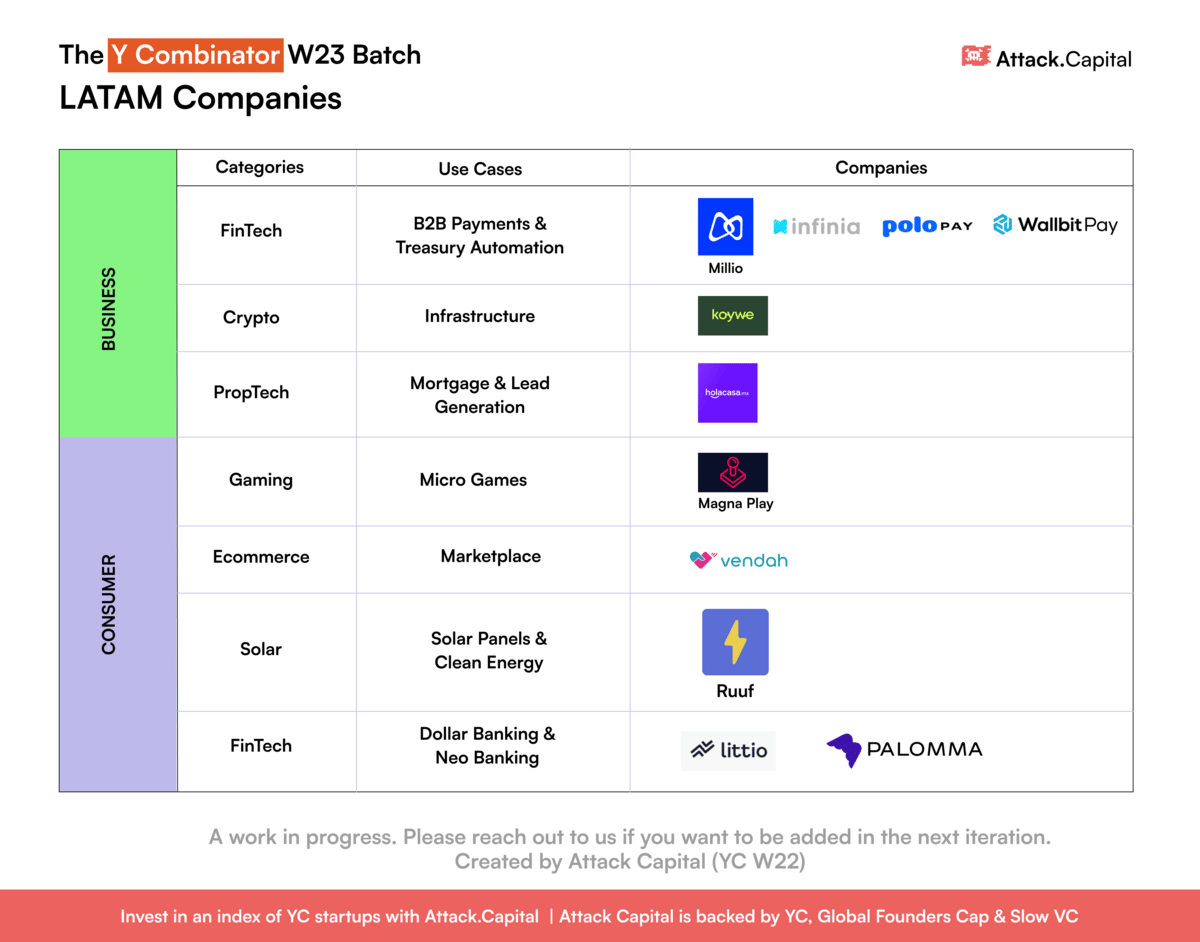

FinTech is the flavor of the season, continuing the strong showing of the past couple of batches - in S21, 42% of LATAM’s YC batch was Fintech, 64% in W22, 60% in S22, and 60% in the current W23 batch.

Experienced entrepreneurs and operators are behind in crypto/web3 companies amid the bloodbath in crypto/web3 - a great sign for the sector and the region.

The Real Estate / Proptech space is cooling down, in the W22 batch, 15% of the startups from LATAM were from PropTech, this batch has only 1 startup.

Startups with innovative business models in the gaming, climate, and ecommerce sector will be an interesting addition to this year's batch.

Founders - Juan Carlos (JC) Garza Rodriguez and Eric Yáñez

Holacasa helps real estate brokers with end-end mortgage solutions to offer customers, having instant quotes, pre-qualify and apply to their mortgage fast and simply with a white-label solution. Real Estate companies have dashboards, real-time status, and a ranking of their potential leads.

Key Insights - Currently, Holacasa is partnered with 15+ financial institutions, including Scotia Bank, HSBC, Santander, and Citibanamex. They provide mortgage approval in 1 to 4 days, while the normal process takes up to 15 to 20 days with enormous paperwork in between.

Holacasa App

Founders - Daniel Gómez and Juan Luis Perez Escobar

Embedded B2B payments and lending infrastructure that enable digital and credit-based B2B commerce in Latin America. Milio offers a single API for any B2B transaction paid in real-time to your bank account, regardless of if it's a credit or a debit-based transaction.

Milio Product Features

Founders - Pedro Esteves and Paulo Rodrigues

MagnaPlay can be used to localize your game in a day instead of waiting for months. They quickly translate anything you give us and send it to our QA team in minutes. Their model does the initial translation, allowing their experts to focus solely on improving the existing text rather than building it from scratch. Their AI also flags potential ambiguities, showing translators the trickiest bits of text they should concentrate on.

Founders - Ianai Urwicz and Alejandro Rettig

Unlike Europe, which has Open Banking (Revised Payment Service Directive - PSD2), each country has its own regulation and payments rails in LATAM. Infinia is building a solution for merchants and payments providers, a ‘Pay by Bank’ to their consumers which helps merchants save ~80% on credit card payment processing fees.

Key Insights - They have 18 clients in Uruguay, Paraguay, and Brazil, such as Mevuelo, Cerámicas Castro, and Barraca.

Founders - Luis Huertas, Iván Torroledo Peña and Christian Knudsen Daccach

Littio is a dollar bank account for Latin America. We help millions avoid currency devaluation by offering easy access to savings in USDC and a Mastercard debit card.

Key Insights - Partnership with three companies - MasterCard, Circle, and

Colombia FinTech.

Littio Virtual Card

Founders - Marcelo Canovas, Luis Felipe Franco, and Ilana Nasser

Vendah helps women in LATAM make extra money by reselling kitchens and homeware to neighbors and friends. A reseller can take orders and collect payments with our mobile app - we then ship bulked products at once to a single reseller. She'll take care of the last-mile delivery, making the economics super attractive. We've already got 15,000 women selling on our platform, growing revenue consistently at a 25% monthly pace with a double-digit positive gross margin.

Founders - Guillermo Acuña and Ignacio Detmer

We provide simple, well-documented, and fully compliant payment APIs and SDKs so that any developer can instantly start leveraging crypto to offer services like remittances, USD wallets, and investments.

Key Insights - They are live, with local on & off payment rails in Chile, Mexico, Colombia, and Peru, and growing 5x M-o-M. Soon they’ll be in Brazil, Argentina, and Central America.

Founders - Tomás Campos, Domingo García-Huidobro and Pedro Saratscheff

Ruuf offers no-money-down installations that generate free money for homeowners from day one. The company is digitalizing the whole process of going solar. Instead of using traditional forms and leaving them up to customers to fill them, Ruuf uses technology to take all that burden off our customers' plates. Ruuf only asks for an address and offers free instant quotes.

Key Insights - 2X M-o-M growth (October 2022).

Founders - Juan Chomali, Andres Richardson, and Aldo Piaggio

PoloPay leverages behavioral data to help restaurants, hotels, and social clubs enhance their guest experience. By using unique QR codes at tables and rooms, guests can easily browse, order and pay for food, drinks, and services. At the same time, the establishment benefits from valuable insights and analytics, enabling them to make data-driven decisions. PoloPay’s goal is to support the hospitality industry through network benefits, data-centered products, and fostering a cohesive ecosystem as they grow.

Key Insights - They are live in the US, Mexico, and Honduras and are launching in LATAM soon.

Founders - Tomás Bruzza, Braian Nicolas Fritz, Martin Tito Gira and Rodrigo Vidal.

Wallbit is a neobank for global remote workers where they can receive their salary, invest in the US market, and withdraw in crypto or local currencies.

Key Insights - Charges only 2% exchange fees while other competitor charges around 5% to 8%.