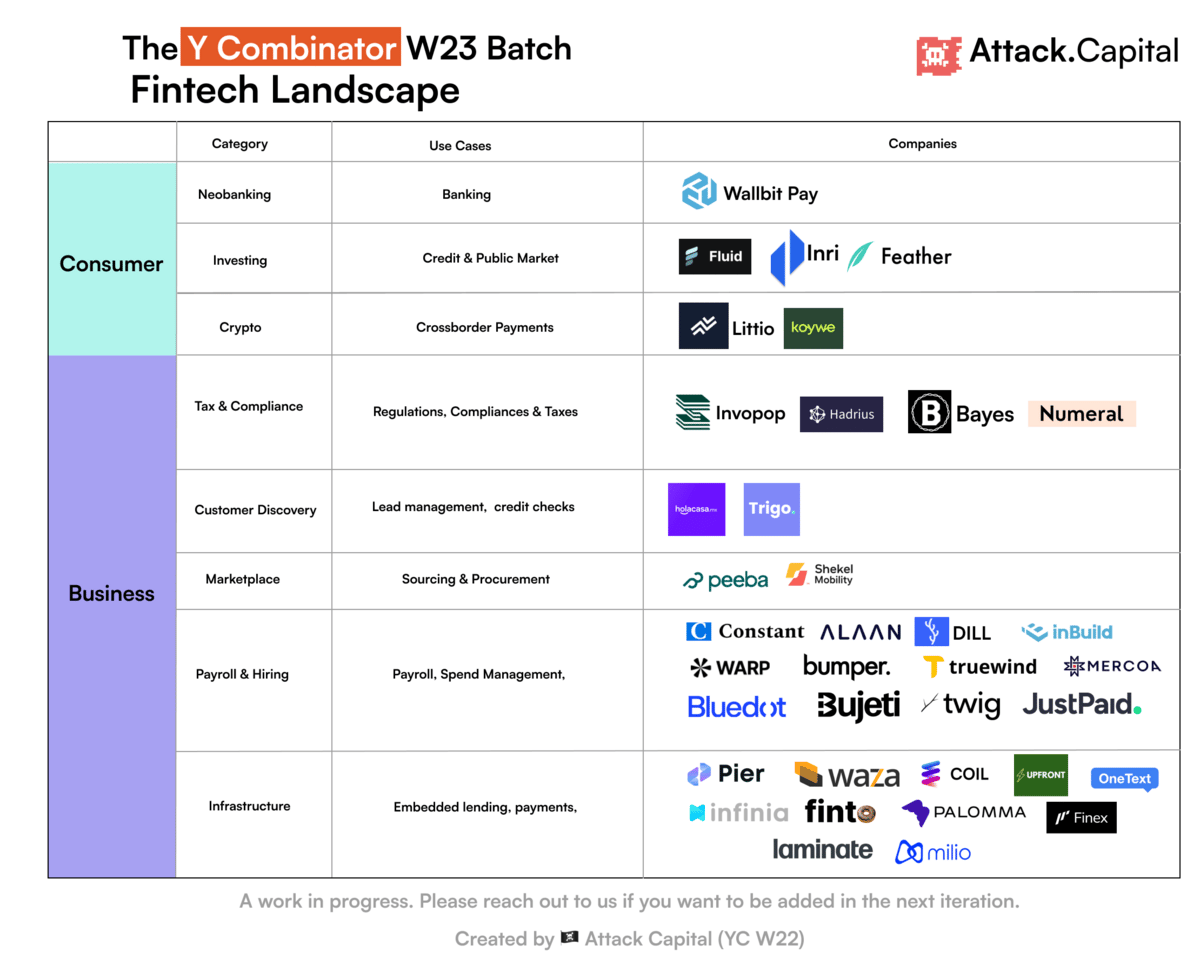

Founders - Smeet Bhatt, Vikas Choudhary & Sriram Bhargav K

Theya builds financial products that enable high-net-worth, tech-affluent households to accumulate "on-chain" Bitcoin wealth. They help families secure and self-custody their bitcoin without feeling overwhelmed or fearful of loss. They do it through a multi-device, multi-sig wallet that you can set up using your iPhones and Apple Watches. Their future roadmap includes a wide range of Bitcoin-native consumer fintech products such as payments, credit, and investments built on Bitcoin L2 protocols such as Lightning and Taro.

Founders - Andrew Hoskins & Thomas Stephens

Upfront helps merchants that sell clean energy products by turning billions of dollars of rebates into dramatically lower prices at checkout. Instead of filling out paperwork and waiting 6 months for a check, our software instantly applies rebates and manages the settlement in the background.

Founder - Ayush Sharma

Warp makes it easy for founders to hire, onboard, and pay their employees in all 50 US states. They handle compliance that existing solutions don't, saving hundreds of hours of admin work for founders annually. Since launching a few weeks ago, they have already processed tens of thousands of $$ in payroll for our customers and helped them comply in several US states.

Founders - Alex Hegevall Clarke & Jessica Zhang

Pier building an API for launching credit products. They enable any company to offer credit by handling origination, underwriting, compliance, and servicing with just a few lines of code. Using Pier, customers can provide credit to their borrowers/users without ever directing them outside their app, while Pier’s API powers it all under the hood.

Founder - Ben Sender

Constant lets financial advisors and high-net-worth individuals invest in top private credit funds. We’re unlocking a compelling asset class that offers high yields, strong risk-adjusted returns, and intelligent diversification.

Founder - Catherine Jiang

Dill is a digital invoicing & payments tool for food service distributors. Did you know distributors are processing hundreds of invoices each day? We’re bringing that process online and built specifically for the food supply chain.

Founders - Tomás Bruzza, Braian Nicolas Fritz, Martin Tito Gira & Rodrigo Vidal

Wallbit is a neobank for global remote workers who can receive their salary, invest in the US market, and withdraw in crypto or local currencies. Wallbit Charges only 2% exchange fees, while other competitors charge around 5% to 8%.

Founders - Luis Huertas, Iván Torroledo Peña & Christian Knudsen Daccach

Littio is a dollar bank account for Latin America. They help millions avoid currency devaluation by offering easy access to savings in USDC and a Mastercard debit card. Partnership with three companies - MasterCard, Circle, Colombia FinTech

Founder - Emmanuel Igbodudu & Maxwell Obi

Waza is a B2B platform that provides the rails for global payments and emerging market trade. We make it seamless and more affordable for African businesses to fulfill their global payment obligations, treasury, and liquidity needs.

Founders - Samuel Lown & Juan Moliner Malaxechevarrí

Invopop is a platform that makes it easier for developers to convert sales into electronic invoices anywhere in the world. For example, a developer at a company with operations in multiple countries only needs to create a single integration with an open-source format, send it to Invopop, and forget about all the stress of building PDFs, compliance with tax agencies, and integrations with ERPs or other systems.

Founders - Juan Carlos (JC) Garza Rodriguez & Eric Yáñez

Holacasa helps real estate brokers with end-end mortgage solutions to offer customers an instant quote, pre-qualify and apply to their mortgage quickly and simply with a white-label solution. Real Estate companies have dashboards, real-time status, and a ranking of their potential leads. Currently, Holacasa is partnered with 15+ financial institutions, including Scotia Bank, HSBC, Santander, and Citibanamex. They provide mortgage approval in 1 to 4 days, while the normal process takes up to 15 to 20 days with enormous paperwork in between.

Founders - Kevin Cho & Jacky L

Peeba is a B2B wholesale marketplace changing how retailers across Asia purchase inventory. They’ve streamlined the sourcing and procurement process, making it easier than ever for retailers to access top-selling products from brands worldwide while providing on-platform buy-now-pay-later options and simplifying cross-border logistics. With Peeba, retailers can focus on what they do best - running their business and serving customers.

Founders - Ian Sharp & Ty Sharp

inBuild boosts revenue for home builders by automating the thousands of invoices they receive for every project. For example, when a subcontractor sends an invoice for work they completed, inBuild checks the cost against the project budget handles any approvals, pays the bill and updates Quickbooks.

Daniel Gómez & Juan Luis Perez Escobar

Embedded B2B payments and lending infrastructure that enable digital and credit-based B2B commerce in Latin America. Milio offers a single API for any B2B transaction paid in real-time to your bank account, regardless of if it's a credit or a debit-based transaction.

Founders - Benjamen Oladokun & Sanmi Olukanmi

Shekel Mobility’s platform helps car dealers find, finance, and sell more cars in the $30B African used Car market. They build the most significant auto dealership ecosystem, powering $10Bn transactions annually.

Founders - Hemant Gangolia & Nishad Shah

India is set to be one of the fastest-growing major economies, and Indian ex-pats have a unique opportunity to invest in this dynamic growing market. As an Indian expat looking to invest in India, investing in India is a daunting experience, with multiple operational hurdles and complex tax and repatriation regulations. Inri solves these challenges by providing a seamless investment platform consisting of personalized wealth advisory and compliance services.

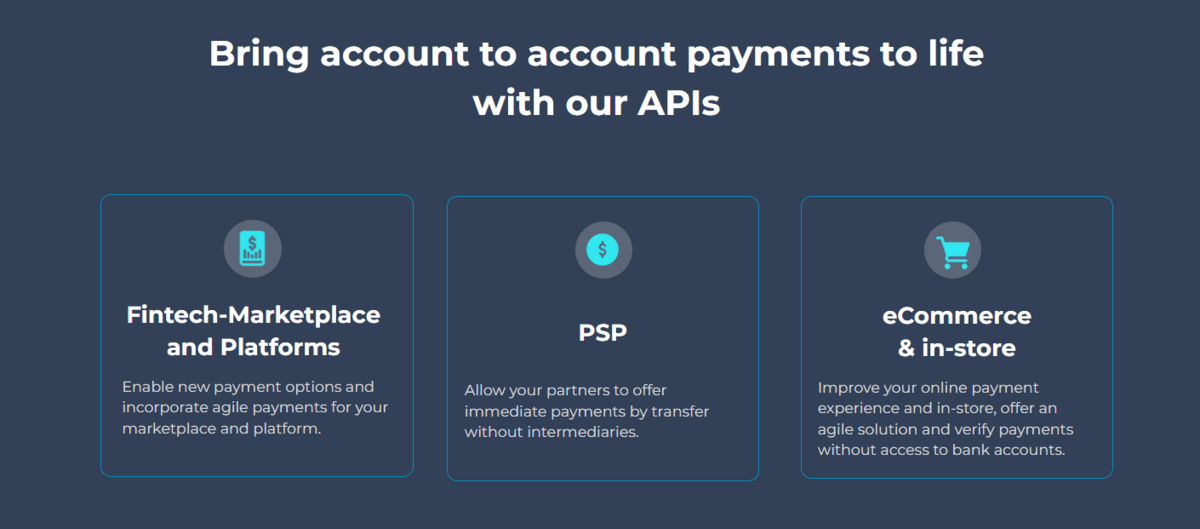

Founders - Ianai Urwicz and Alejandro Rettig

Unlike Europe, which has Open Banking (Revised Payment Service Directive - PSD2), in LATAM, each country has its own regulation and payments rails. Infinia is building a solution for merchants and payments providers, a ‘Pay by Bank’ to their consumers which helps merchants save ~80% on credit card payment processing fees. They have 18 clients in Uruguay, Paraguay, and Brazil, such as Mevuelo, Cerámicas Castro, and Barraca.

Founders - Guillermo Acuña and Ignacio Detmer

Koywe provides simple, well-documented, and fully compliant payment APIs and SDKs so that any developer can instantly leverage crypto to offer services like remittances, USD wallets, and investments. They are life, with local on & off payment rails in Chile, Mexico, Colombia, and Peru, and growing 5x M-o-M. Soon they’ll be in Brazil, Argentina, and Central America.

Founders - Kenneth Book, Ben Litvin & Ari Wax

Fluid Markets is enabling investments in the fundamentals of public companies. Invest in earnings, revenue, regions, and business segments of companies, without having to buy the stock.

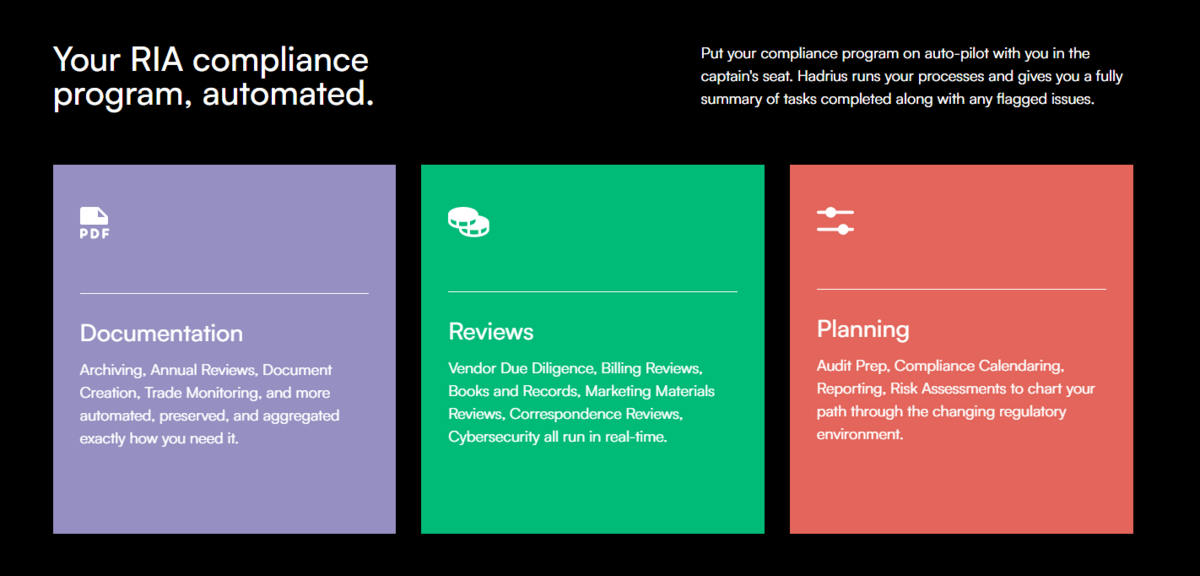

Founders - Allen Calderwood, Thomas Stewart & Som Mohapatra

Hadrius automates the entire SEC ongoing compliance process with AI, saving compliance teams 70%+ of the time and with better accuracy than humans. 30,000+ financial firms spend a combined total of $16b+ a year on ongoing SEC compliance, and with regulations tightening every year, these costs continue to rise. At the same time, the existing solutions can hardly keep up, with most firms paying for third-party consultants, law firms, and 2-decade-old software - while still relying on ongoing manual work to make up the gap.

The result: upwards of $10k/year per employee spent on regulatory compliance and thousands of hours of tedious tasks at each financial firm. As an SEC-registered RIA themselves, they've faced these challenges firsthand and developed Hadrius for our own fully-automated compliance program. They aim for a world where compliance is the effortless state of financial firms, rather than constant worry requiring expensive vigilance to maintain.

Founders - Cedric Priscal, Alberto Guillen & Dominic Spinozzi

Berilium is a digital wealth management platform for investors to access actively managed portfolios of alternative strategies (i.e. private equity, private credit, etc.).

Founders - Carlos Reyes Stoneham, Brent Traut

Rainmaker is a crypto wallet that gives you one-tap, direct access to complex DeFi strategies. You can earn yield on crypto positions securely, without the complexity of seed phrases or gas fees.

Founders - Tennison C & Alex Lee

Truewind (YC W23) is AI-powered bookkeeping and financial modeling for startups.🤖 Using GPT-3, Truewind captures the business context only founders have, making accounting more accessible and more accurate. Through a combination of AI and concierge service, Truewind delivers a delightful financial back office experience that includes:

Reliable bookkeeping with fewer errors

Detailed financial models

Built exclusively for startups

Fast, responsive expertise

Founders - Max Deichmann, Marc Klingen & Clemens Rawert

Finto solves quote-to-cash (QTC) for sales-led B2B SaaS companies with the proposition ‘whatever you quote, Finto bills automatically’. In Finto, users can: create flexible sales quotes, turn them into active subscriptions, invoice customers, upsell/cross-sell on top of an existing subscription at any time, reconcile payments, and have a single view of each customer. The entire process runs on one data structure, thus eliminating the integration issues of current solutions, which result in errors and manual handovers. As sales-led B2B SaaS companies look into product-led upsell and expansion, Finto enables them with an API to its holistic solution.

Founders - Andrew Kim & Uladzislau Radkevich

Our platform provides access to a bank account, fast and cheap international transfers, and financial insights from all popular e-commerce services.

Founders - Ferhat Babacan & Selinay Parlak

Bluedot is building connected financial products to accelerate EV adoption. We bring to market a first-of-its-kind, universal charging payment and rewards platform for those individual and fleet drivers, connecting the EV experience to a larger and more integrated retail opportunity.

Founders - Ryan Hall & Eleazar Vega-Gonzalez

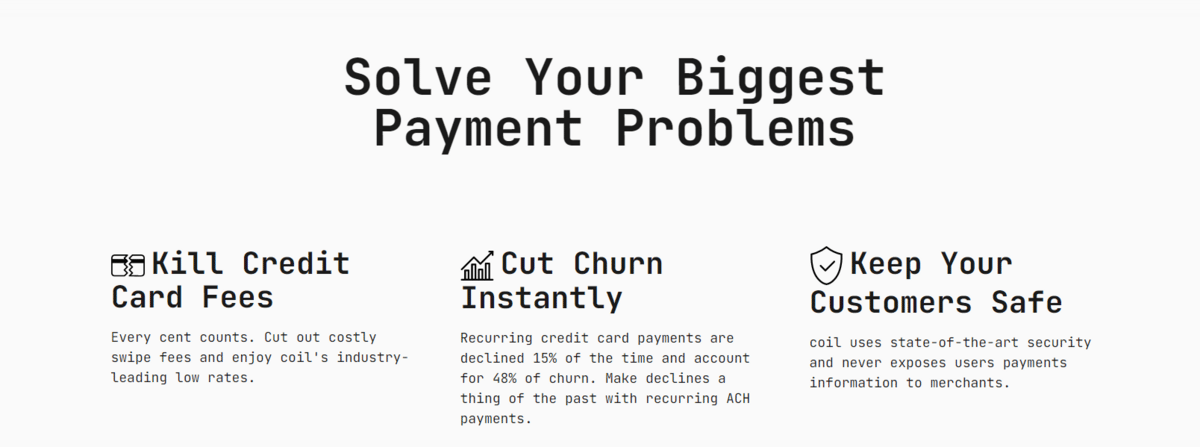

Coil helps merchants seamlessly accept bank payments to reduce processing fees and churn.

Founders - Samy CHIBA & Cossi Achille AROUKO

Bujeti is a corporate cards and expense management platform for African businesses. We help African businesses issue corporate cards to their employees, control and manage their expenses and keep track of their finances.

Founders - Sam Stein & Abe Wheeler

Trigo aggregates rent payment data to help lenders identify creditworthy borrowers and write more loans. We’ve already consolidated tens of thousands of rental units, helping lenders underwrite loans for the 60 million thin-credit borrowers in the U.S.

There are over 300 million loan originations annually in the U.S., and lenders pay $15-$200 per loan for underwriting data. In 2021, Fannie Mae, Freddie Mac, and other financial institutions included rent payments data in their underwriting models to expand access to credit. However, no solution exists to provide this data to these lenders at scale.

Trigo is a federally regulated Consumer Reporting Agency (CRA) that provides this missing rent data set to lenders through a real-time API. We’ve already consolidated over 40,000 units to provide instant data to lenders. Where we don’t yet have data coverage, we automate outreach to landlords for our lenders.

Founders - Jesse Buckingham & Mike Carter

Vooma is a back-office automation platform for freight brokers and carriers that fully automates order-taking from shippers. Vooma help logistics companies focus on work that drives business value.

Mike built self-driving trucks as a founding engineer at Kodiak Robotics (prev. Uber, Otto) and led their motion planning and safety teams. Jesse grew a private equity-backed logistics software company from $2M to $20M+ as CEO.

Founders - Anelya Grant Janssen & Daniel Kivatinos

Workflows of start-up financial data are broken today, we aim to fix this. Startups can use their financial flow, payables, and receivables within our platform. Loopfour is the AI-powered controller you wish you had earlier, so you will never have to worry about overpaying bills again.

Founders - Suchit Dubey & Akshit Khurana

Bill.com for logistics. Narrative provides contract management and auditing to reduce invoice errors for the shippers and logistics providers.

Founders - Patrick Higgins & Ash Rai

Founded in December 2022, Feather is the first integrated, one-stop solution for retail traders to analyze investments worldwide. Feather covers all major asset classes and geographies, from equities, options, and bonds to commodities, currencies, and macroeconomics. Feather also provides data on 11,000 institutions (holdings, transactions, etc.) and 10,000 individuals (insider purchases/sales, transaction histories, etc.). Feather’s pricing starts at just $39 per month, empowering customers to make informed, wealth-building investments with data available only to Wall Street until now.

Founders - Miguel Acero, Shariar Kabir & Jordan Yaqoob

Ruby is a neobank that offers e-commerce businesses a flexible spend management solution and direct integrations with commerce platforms.

By combining banking and commerce data, Ruby provides businesses with a real-time, unified view of their financial health and money movement, empowering them to make better financial decisions and scale their operations.

Founders - Shreya Jagarlamudi & Andrew Tang

Pledge helps healthcare practices grow their revenue by automating patient billing and payment collection. It is a payments platform that lets healthcare practices check patient insurance benefits for time-of-service payments, communicate easy-to-understand bills automatically with patients via email/sms, and collect payments online.

Founders - Sai Arora & Sandeep Dinesh

Mercoa lets any B2B fintech offer BillPay and Accounts Payable services to their customers. Use their drop-in iframe or API to offer your users one place to manage and pay all of their invoices.

Founders - Kevin Liu, Jake Moffatt & Sam Ross

Numeral handles all aspects of sales tax, from registration to remittance for e-commerce stores. We offer white-glove service so stores can start working on growing their business.

/

Founder - Khurram Aslam

API for physical credit card manufacturing

Founders - Cipriano Echavarria, Nicolás Gómez del Campo & Felipe Monsalve

Palomma helps online merchants & apps in LatAm save money on card fees & increase conversions by allowing customers (individuals or businesses) to pay directly from their bank at checkout without friction (1-3 steps).

Founders - Caitlin Short & Akanksha Singh

Vertical SAAS for the $650B+ Film, TV, and Music Production Industry. Twig is starting out with our global expense management software for the entertainment industry, which still relies on spreadsheets and paper receipts to manage the $650B+ they spend each year.

Bumper

Founders - Fatma Akcay & Eamonn Gahan

Bumper is the all-in-one finance platform for the supply chain. They can fix the industry-wide broken processes that lead to carriers and 3PLs being paid late on already long (net30+) payment terms. Our platform provides:

Receivables automation and dispute workflows

One-click payables processing + payment (integrated with your order management system for easy approval).

Rate + contract management for carriers and shippers.

Automated invoice auditing.

Founders - Daniel Brain & Jonathan Fudem

OneText turns every phone number into a wallet. We enable frictionless payments using your phone, primarily via SMS.